Recent Posts

- 2026 Tax Filing Season Begins Jan 26th

- Key Dates for the 2026 Tax Season

- IRS 2022 Tax Season Important Dates and Filing Tips

- IRS 2021 Tax Filing Season Begins Feb. 12th

- Yes, BGGE Is Open with Steps To Make 2021 Tax Filing Easier

- Happy New Year! BGGE Covid Projects in 2020 and 2021

- ADOR Issues 2020 Tax-Relief Update

- 2019 Tax Filing and Payment Deadline Extended to July 15th

- 2020 Tax Filing Season Begins Jan. 27

- What Happens If You Miss the Oct. 15th Tax Extension Deadline?

Archives

- January 2026

- January 2022

- January 2021

- April 2020

- March 2020

- January 2020

- October 2019

- September 2019

- August 2019

- January 2019

- January 2018

- August 2017

- January 2017

- August 2016

- April 2016

- January 2016

- July 2015

- January 2015

- December 2014

- November 2014

- April 2014

- January 2014

- December 2013

Tags

2026 Tax Filing Season Begins Jan 26th

In a press release on January 8th, The Internal Revenue Service announced that the nation's tax season will start on Monday, January 26, 2026. That is when the IRS will begin accepting and processing 2025 tax-year returns. Taxpayers have until Wednesday, April 15, 2026, to file their returns, pay any tax due, and/or file for an extension of time to file.

In a press release on January 8th, The Internal Revenue Service announced that the nation's tax season will start on Monday, January 26, 2026. That is when the IRS will begin accepting and processing 2025 tax-year returns. Taxpayers have until Wednesday, April 15, 2026, to file their returns, pay any tax due, and/or file for an extension of time to file.

Several new tax law provisions of the One, Big, Beautiful Bill become effective this year and could impact federal taxes, credits, and deductions. Many experts predict many taxpayers will see an increase in their refunds. However, that depends on your actual tax situation.

According to IRS Chief Executive Officer Frank Bisignano, “The Internal ......

Key Dates for the 2026 Tax Season

The official start date for the 2026 tax season is Monday, January 26, 2026. For most individuals, the main deadline to file or extend is April 15, 2026. The extension deadline is October 15, 2026 although payments are still due by April 15.

The IRS strongly encourages taxpayers to wait until they receive all income and information documents (like W-2s and 1099s) before filing to avoid errors, processing delays, and having to file an amended return, which can take months to process. Filing with incomplete information can lead to mismatches with IRS records, potentially stopping your return and refund until discrepancies are resolved.

Because the majority of BGGE bookkeeping clients are sole proprietors who ...

IRS 2022 Tax Season Important Dates and Filing Tips

The Internal Revenue Service announced that the nation's tax season will start on Monday, January 24, 2022. That’s when the IRS will begin accepting and processing 2021 tax year returns. This start date allows the IRS time to perform programming and testing that is critical to ensuring that IRS systems run smoothly.

The Internal Revenue Service announced that the nation's tax season will start on Monday, January 24, 2022. That’s when the IRS will begin accepting and processing 2021 tax year returns. This start date allows the IRS time to perform programming and testing that is critical to ensuring that IRS systems run smoothly.

Many commercial tax preparation software companies and tax professionals started accepting and preparing tax returns earlier in the month. But the completed returns are to be held until they can be filed electronically with the IRS on January 24th.

For most taxpayers, the filing deadline to submit 2021 tax returns, an extension, and/or pay taxes owed is Monday, April 18, 2022 instead of April 15th. Taxpayers in Maine...

IRS 2021 Tax Filing Season Begins Feb. 12th

On January 15, 2021, the Internal Revenue Service announced that the nation's tax season will start on Friday, February 12, 2021. That's when they will begin accepting and processing 2020 tax year returns. The February 12th date would allow the IRS time "to do additional programming and testing of IRS systems to reflect the December 27th tax law changes that provided a second round of Economic Impact Payments and other benefits'. They also feel the later date will reduce refunds delays and ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

On January 15, 2021, the Internal Revenue Service announced that the nation's tax season will start on Friday, February 12, 2021. That's when they will begin accepting and processing 2020 tax year returns. The February 12th date would allow the IRS time "to do additional programming and testing of IRS systems to reflect the December 27th tax law changes that provided a second round of Economic Impact Payments and other benefits'. They also feel the later date will reduce refunds delays and ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

FYI: Although tax seasons frequently begin in late January, there have ......

Yes, BGGE Is Open with Steps To Make 2021 Tax Filing Easier

The IRS has not officially announced this year's tax season start date yet, but BGGE tax season starts on January 2nd every year. As a bookkeeper, I crunch numbers before, during, and after the national tax season deadlines. Since most of my business clients are sole-proprietors, I create their chart of accounts and reports in-line with the Schedule C.

The IRS has not officially announced this year's tax season start date yet, but BGGE tax season starts on January 2nd every year. As a bookkeeper, I crunch numbers before, during, and after the national tax season deadlines. Since most of my business clients are sole-proprietors, I create their chart of accounts and reports in-line with the Schedule C.

But tax planning is for everyone. Having your records organized, not only makes preparing your return easier, but a paid preparer may reduce your fees because of this. It may also help you discover potentially overlooked deductions or credits.

Remember, most income is taxable even if you do not receive a form. Written documentation is often ...

Happy New Year! BGGE Covid Projects in 2020 and 2021

Happy New Year! It has always been my aim to provide cost-effective and quality services to my clients. BGGE has grown over the years because of them. For me, success is about more than money and wealth. It is also about the friendly and honest relationships that I have developed with my clients and business partners. With my sincerest gratitude, I wish you and your family a Happy New Year!

Happy New Year! It has always been my aim to provide cost-effective and quality services to my clients. BGGE has grown over the years because of them. For me, success is about more than money and wealth. It is also about the friendly and honest relationships that I have developed with my clients and business partners. With my sincerest gratitude, I wish you and your family a Happy New Year!

At the beginning of 2020, I had big plans for BG&G Enterprises and BGGE.com. Semi-retired, I wanted to provide more resources to help my clients. I also wanted to focus on more design, creative writing, and ecommerce projects. I had already penciled in my editorial...

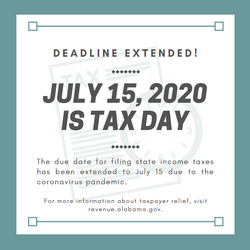

ADOR Issues 2020 Tax-Relief Update

2019 Tax Filing and Payment Deadline Extended to July 15th

The deadline for tax filing and payment of 2019 tax returns has been extended from April 15 to July 15, 2020. This special tax filing and payment relief is offered to individuals and businesses in response to the COVID-19 Outbreak by the Treasury Department and the Internal Revenue Service.

The deadline for tax filing and payment of 2019 tax returns has been extended from April 15 to July 15, 2020. This special tax filing and payment relief is offered to individuals and businesses in response to the COVID-19 Outbreak by the Treasury Department and the Internal Revenue Service. State filing and payment deadlines vary from state to state. More information is available at https://www.taxadmin.org/state-tax-agencies.

More Highlights of IRS News Release:

- Relief applies to all individual returns, trusts, ... ...

2020 Tax Filing Season Begins Jan. 27

The Internal Revenue Service will begin accepting and processing 2019 tax year returns on Monday, January 27, 2020. They set this date "to ensure the security and readiness of key tax processing systems and to address the potential impact of recent tax legislation on 2019 tax returns." Income tax returns with the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) will not be processed until mid-February as dictated by law. These credits have often been abused so the additional time allows the IRS to verify that taxpayers actually qualify for them.

The Internal Revenue Service will begin accepting and processing 2019 tax year returns on Monday, January 27, 2020. They set this date "to ensure the security and readiness of key tax processing systems and to address the potential impact of recent tax legislation on 2019 tax returns." Income tax returns with the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) will not be processed until mid-February as dictated by law. These credits have often been abused so the additional time allows the IRS to verify that taxpayers actually qualify for them.What Happens If You Miss the Oct. 15th Tax Extension Deadline?

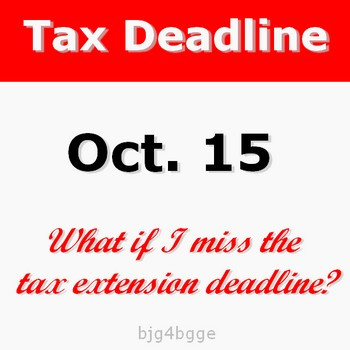

The October 15th deadline is fast approaching for taxpayers who filed Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. State tax extension deadlines vary by state. Alabama's deadline is the same date as the federal deadline. Special tax extension deadlines were approved for certain members of the military serving in combat zones, taxpayers living outside the U.S., and those living in declared disaster areas, if they qualified.

Although some taxpayers were given at least six extra months to file their taxes, they are still procrastinating. Many have misplaced their W-2's, 1099's, and other financial documents. Or they may be still ...

...- Page 1 of 3